Can I withhold a progress payment if there are defects?

After many months and sometimes years of planning and dreaming, it is extremely exciting to see your new home progressing and starting to take shape.

As each stage of your build is completed, the builder will be requesting payment as set out in your building contract. Handing over tens of thousands of dollars can be nerve-wracking and we’re often asked, ‘Should I make payment yet?’ or ‘Can I hold off on making payment until they rectify XYZ?’.

Making payment can be frustrating if you are not satisfied with the work that has been completed however, you cannot withhold progress payments because of defects, provided the stage has been completed. It may be tempting to hold onto payment to encourage some action on site but doing so may leave you in contractual breach.

Before you make each progress payment to your builder, check the work:

- is complete

- meets the definition set out in your contract

- has passed the Relevant Building Surveyor’s inspection (typically only related to frame stage)

In addition to checking to ensure all work meets the relevant standards for quality, an independent building inspection can also help to determine if the stage has been completed before you make progress payments. Once the builder has been paid for their completed work, they will move on to the next stage of construction.

While it is important to keep the build rolling and ensure you are not in breach by delaying payments, it is equally as important is to ensure the payments/claims being requested are in accordance with the building contract and not paid earlier or later.

Builders are bound by law on how and when they collect money from the customer. Sometimes builders may send a progress claim before the stage has been completed, which is in breach of the Domestic Building Contracts Act. If you were to make a stage payment prior to the work being completed and the builder was to go insolvent, then your Domestic Building Insurance (DBI) would not cover these overpaid works. Always refer to your specific DBI policy however some good information can be found on the VMIA website).

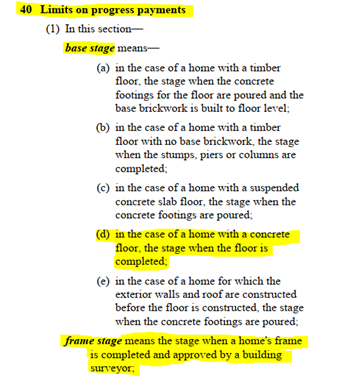

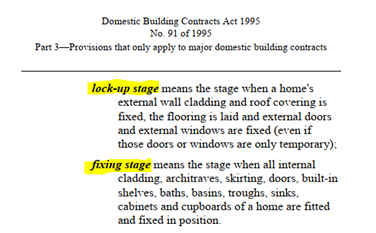

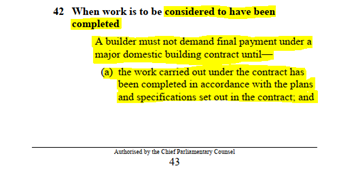

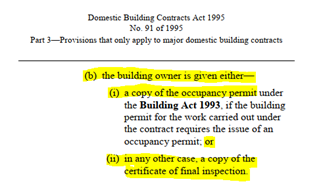

The definitions of each progress payment stage should be clearly outlined in your building contract and were hopefully reviewed prior to signing the contract to ensure that they were as per the standard legal definitions set out in Section 40 and 42 of the Domestic Building Contracts Act 1995, but you must check your specific contract conditions;

Whatever the process stated in the Building Contract needs to be followed. Typically;

- Step 1: Claim received

- Step 2: Review your contract for the definition of that particular stage

- Step 3: Review works on site to ensure it has reached the contractual definition

- Step 4: Review the amount of the stage reflects your contract

- Step 5: Make/approve payment:

Some clients concentrate solely on the amount issued in the claim is the same as the contract, but the definition is just as important.

The reasoning behind this is to protect you in case of a catastrophic event or the “three D’s” if the builder:

- is Declared insolvent

- Dies

- Disappeared

Insurance companies will not pay out on any works that have been overpaid, ensure you check your own specific policy.

The only stage where you have some power to withhold payment until defects are rectified is the final stage. It is however extremely important that you follow the specific steps outlined in your building contract. This is a whole other topic and process we will cover shortly.

In summary, the critical points are:

- Check your contract definitions – what it states, matters

- If the claim has reached the stage definition, ensure you or your bank is not slow with payment to ensure you don’t become in breach of contract

- Check your Domestic Building Insurance certificate/policy – ensure the details in this policy i.e. names, numbers and addresses are identical to the details in your building contract.

The above are general tips and our point of view. Each contract and build is different so ensure you refer to its specific contract conditions. This is not legal advice; if you need legal advice, contact a legal professional.

Want more information?

Looking for support throughout your build? Our thorough independent building inspections at each stage will ensure your home meets the relevant standards for quality. Contact our friendly team to discuss your build today.