Domestic Building Insurance is essential to protect your deposit

So, you have made your selections and upgrades for your new home, the builder has input data into the New Homes Contract (Major Domestic Building Contract) and you have completed your thorough Contract Review (or engaged an Independent Building Consultant to review it for you also). The next steps the builder/builder’s representative will be advising is to sign the contract and pay your deposit. Right?…Wrong!

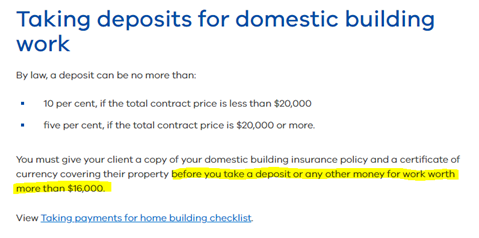

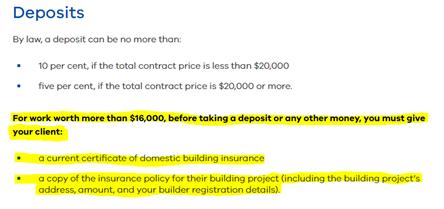

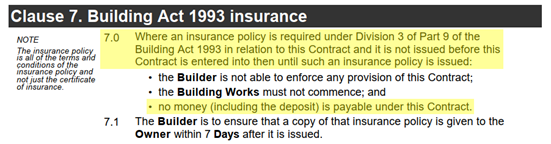

With the current climate in the construction industry, it has never been more pivotal to ensure your builder is following the provisions of the contract so that your deposit is protected should things not go to plan. Domestic Building Insurance provides cover to homeowners for incomplete or defective building work and is essential to protect your hard-earned cash. Builders in Victoria are required by law to take out Domestic Building Insurance, also known as Builder’s Warranty Insurance, for work valued at more than $16,000.

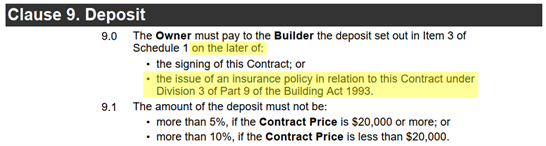

There will be clear information within your building contract with regards to when you need/should pay your deposit.

For new home builds over $20,000, the deposit amount is typically 5% of the contract value (minus any previous preliminary minor deposits amounts paid). The last thing you want is to lose your deposit should your builder became one of the three ‘D’s’:

- Declared insolvent

- Died

- Disappeared

Domestic Building Insurance is essential to ensure you are protected should one of these D’s occur.

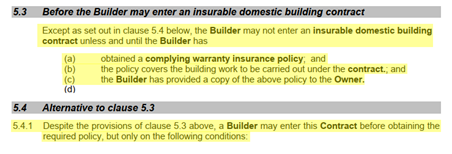

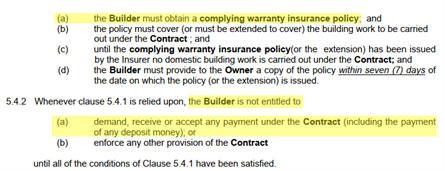

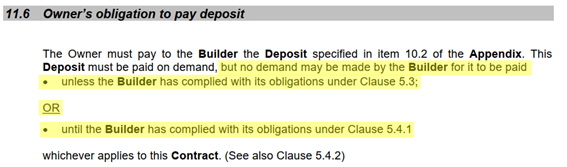

Your builder is required to supply evidence that this insurance has been taken out prior to the deposit being paid so if not supplied to you, be sure to request this important insurance certificate policy before making any payments.

The below snippets are from common New Home Building Contracts;

Consumer Affairs also has some great guidance on this:

The links to Consumer Affairs can also be found here;

- consumer.vic.gov.au/licensing-and-registration/builders-and-tradespeople/running-your-business/deposits-and-payments

- consumer.vic.gov.au/licensing-and-registration/builders-and-tradespeople/checklists/taking-payments-for-building

Even if you have signed a contract or are about to sign, ensure you get this important insurance certificate policy and information to ensure your deposit is protected.

Building a new home should be an exciting time so stay positive about the journey, the best way to have confidence from the very start is to have a clear understanding of your building contract and the contractual obligations of yourself and your builder.

Want more information?

Contact our friendly team about your build, our experienced team of building contract specialists can review your building contract in Geelong. Looking for support throughout your build? Our thorough independent building inspections at each stage will ensure your home meets the relevant standards for quality.

Disclaimer – this is not legal advice; each contract is different and specific to the build. If you need legal advice, contact a legal professional.